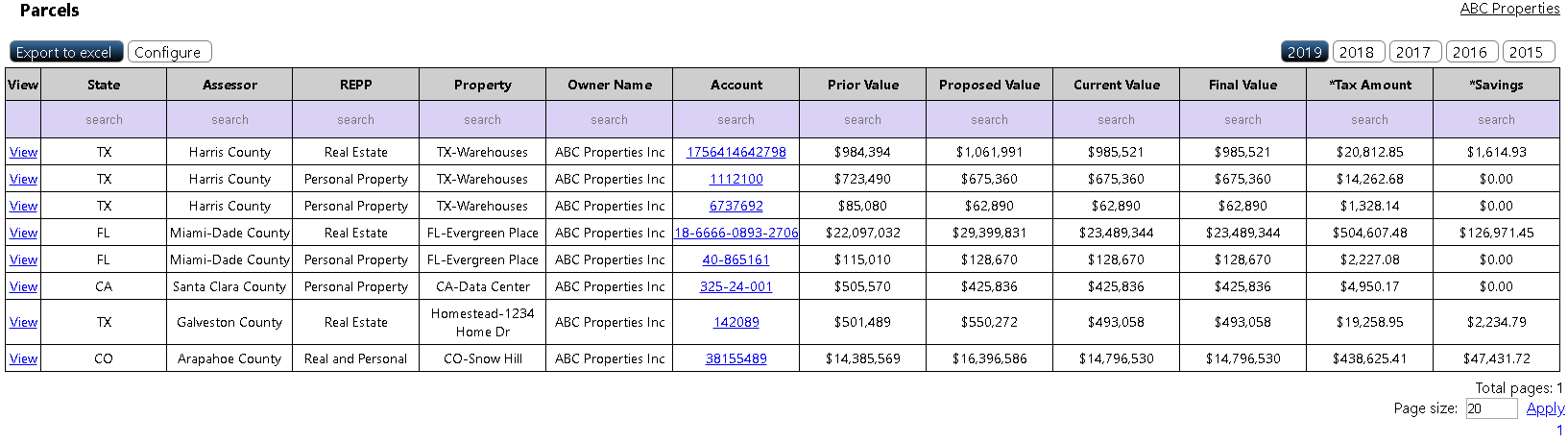

Parcels

REPP -

Real/Personal PropertyProperty -

Name of PropertyOwner Name -

Individual/Company (the Legal Entity responsible for Tax Liability)Account -

The Assessors Account NumberPrior Value -

Last year's Market ValueProposed Value -

The initial Value received from the AssessorCurrent Value -

The Current ValueFinal Value -

When a value is Final, this indicates that either the appeal process has been completed or the appeal deadline has passed. This should be considered as actual and not an estimate.*Tax Amount -

Estimation of taxes due, for actual Tax Amounts please refer to the Tax Bill*Savings -

Estimated Savings based on (prior year tax rates / current year final rates). Savings are subject to change as the current year tax rates become finalized.Parcel Details

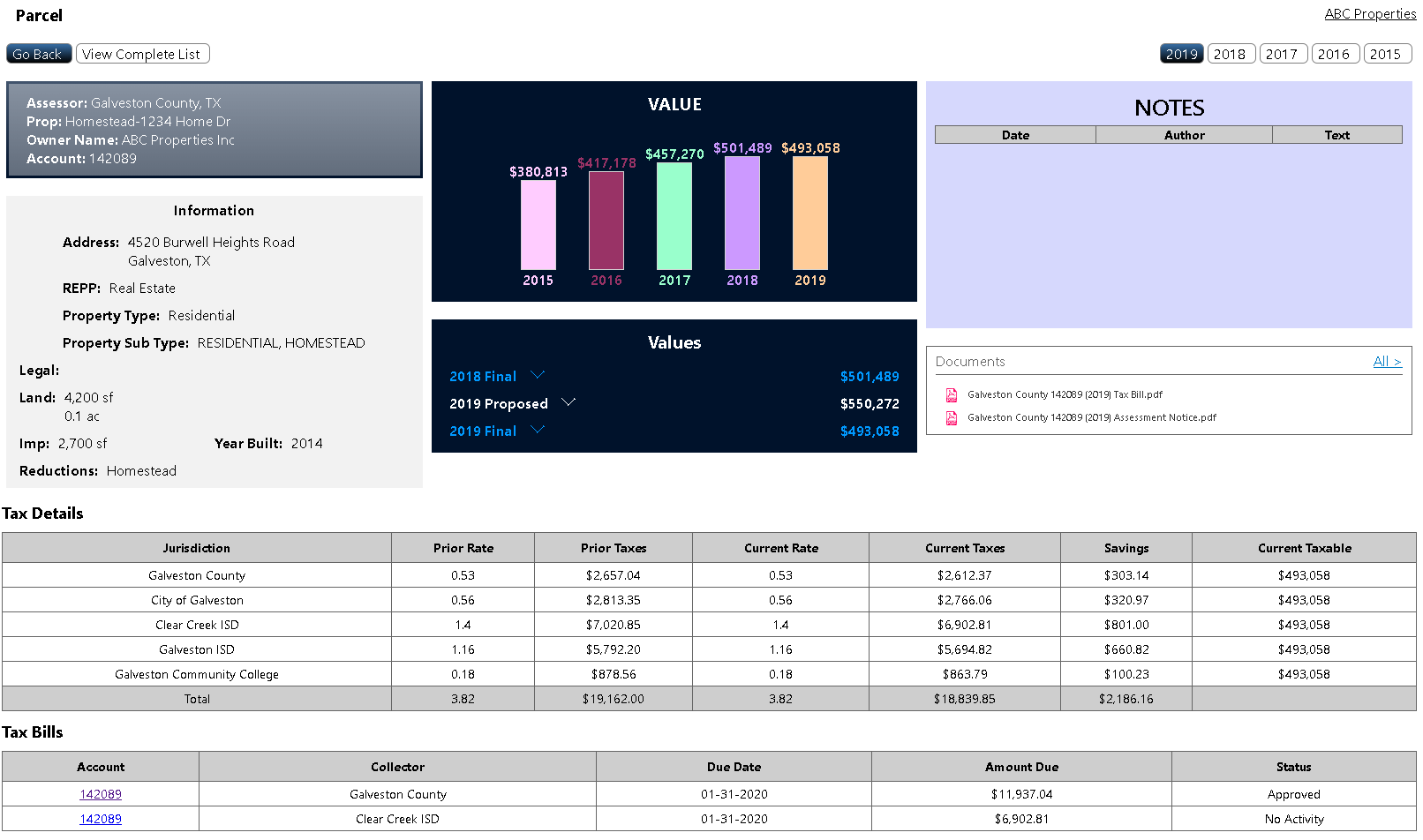

Information

Address - Situs Address

REPP - Real/Personal Property

Property Type - Commercial, Residential, Agricultural, Industrial, Mineral

Property Sub Type - Varies based on parcel use

Legal - Legal Description provided by the Assessor

Land - Land Acreage/Square Feet

Imp - Building/Structure Square Feet

Year Built - The year the first structure was built.

Reduction - Exemptions/Discounts (Homestead, Over 65, Veteran, etc.)

Tax Details

Jurisdiction - Name of Taxing Jurisdiction

Prior Rate - Prior Tax Year's Tax Rate

Prior Taxes - Prior Year's Taxes

Current Rate - Current Year's Tax Rate (if the Tax Bill status is not approved, this should should be viewed as an estimate and not actual)

Current Taxes - Current Year's Taxes (if the Tax Bill status is not approved, this should should be viewed as an estimate and not actual)

Savings - Savings Per Jurisdiction

Current Taxable - The value that is being used to generate the tax amount

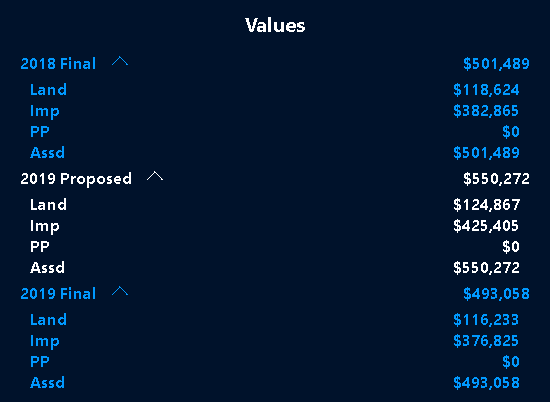

Values

PP (Parcel Values)

Business Personal Property account values contain the (Rendered/Reported) amount and a link to the corresponding Return.

Rendered/Reported - A Rendered amount is an estimated Market Value based on the Taxable Assets that have been reported.