Business Personal Property

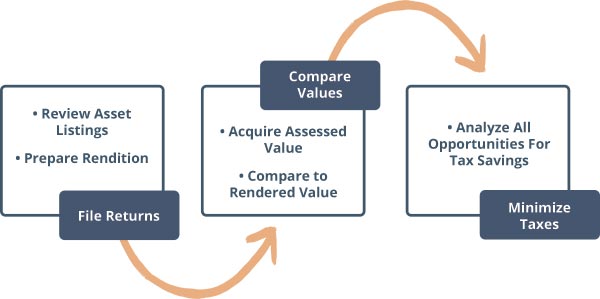

Harding and Carbone files Business Personal Property Returns in all taxable states. All States and Counties have different guidelines and methods of valuation for Personal Property. The deadline to file Personal Property Returns also varies from state to state. Our team manages these deadlines effectively to make sure that our clients do not incur penalties and interest. Let us remove the burden of tracking and verifying these deadlines.

The methods of valuation depend on the type of equipment reported. States and Counties all have their own depreciation tables for different types of equipment. Harding and Carbone will verify that your equipment is being valued in the appropriate category.

Types of equipment that need to be reported are not the same in every State. Typically, if you report it the County will value it. We make sure that you are only reporting what is taxable, according to State guidelines.

Services

- Manage Deadlines

- File Business Personal Proper Returns Timely

- Verify Valuation Method, and Appeal if Necessary

- Tax Bill Verification

- Audit Assistance